Business Insurance in and around Grand Prairie

Calling all small business owners of Grand Prairie!

No funny business here

Help Prepare Your Business For The Unexpected.

Running a small business comes with a unique set of challenges. You shouldn't have to work through those alone. Aside from just your loved ones, let State Farm be part of your line of support through insurance options including a surety or fidelity bond, errors and omissions liability and business continuity plans, among others.

Calling all small business owners of Grand Prairie!

No funny business here

Cover Your Business Assets

Whether you own an antique store, a beauty salon or a lawn care service, State Farm is here to help. Aside from outstanding service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

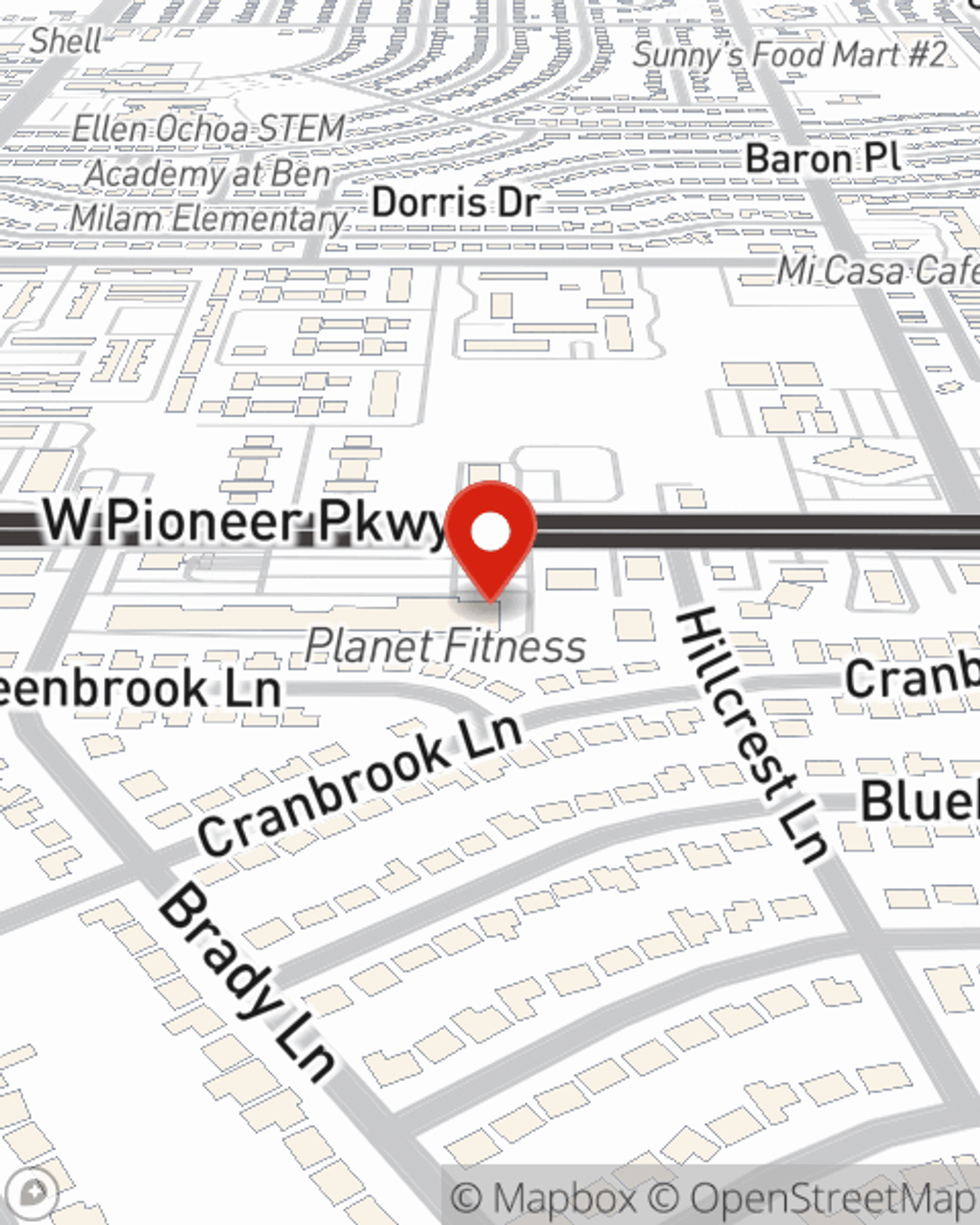

Ready to explore the business insurance options that may be right for you? Visit agent Brian Ownby's office to get started!

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Brian Ownby

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".